In this article we will know in detail about the coming 6 years of “NIO Stock Price Prediction 2025, 2026, 2027, 2030”. But before we start, let me tell you a little about NIO’s past performance. NIO’s share price has been volatile since its 2018 IPO. Initially, it reached a high of $13, but then dropped to $2 in late 2019 due to financial concerns and stiff competition.

NIO bounced back in 2020, earning more money and improving its finances. Its share price rose, especially in the second half, due to good sales, increasing market share and new car models. 2021 was even better, with NIO stock reaching a record high above $60! This was fueled by even stronger sales, more confident investors and enthusiasm for electric cars in general. Therefore, NIO’s share price has seen big fluctuations, but overall it has been climbing since its poor start.

What is NIO?

NIO Inc. is a Chinese multinational electric vehicle (EV) manufacturer founded in 2014. Headquartered in Shanghai, NIO designs, develops, manufactures, and sells premium electric cars, SUVs, and other related services, including battery swapping stations and subscription models. Often referred to as the “Tesla of China”, NIO competes in a rapidly growing EV market with ambitious goals to establish itself as a leading player in the global EV landscape.

Why is NIO’s stock price important?

NIO’s stock price (NYSE: NIO) serves as a key indicator of investor confidence in the company’s future prospects. A rising stock price signifies optimism about NIO’s ability to achieve its strategic goals and capture a significant share of the EV market. Conversely, a falling stock price suggests concerns about challenges facing the company, such as competition, profitability, or geopolitical factors.

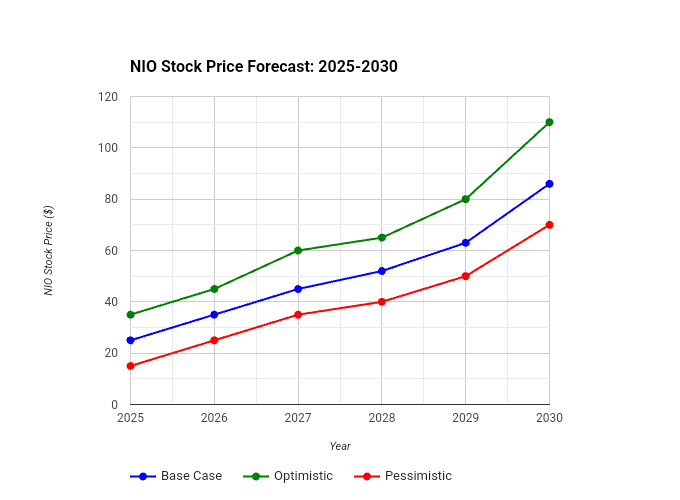

NIO Stock Price Prediction 2025, 2026, 2027, 2028, 2029, 2030 (In Visual Format)

Here are the NIO Stock Price Prediction 2025, 2026, 2027, 2028, 2029, 2030 with a table:

| Year | Base Case Scenario | Optimistic Scenario | Pessimistic Scenario |

|---|---|---|---|

| 2025 | $25-30 | $35-40 | $15-20 |

| 2026 | $35-40 | $45-50 | $25-30 |

| 2027 | $45-50 | $60-70 | $35-40 |

| 2028 | $52-58 | $65-75 | $40-45 |

| 2029 | $63-69 | $80-90 | $50-55 |

| 2030 | $86-92 | $110-130 | $70-75 |

Here are the NIO Stock Price Prediction 2025, 2026, 2027, 2028, 2029, 2030 with a graph:

NIO Stock Price Prediction 2025, 2026, 2027, 2028, 2029, 2030

NIO’s stock price forecast 2025, 2026, 2027, 2030 faces uncertainties in the growing electric vehicle sector. We examine various factors, such as economic trends, market conditions, and analyze company-specific drivers to make the best possible estimate of NIO’s stock price in the coming years. Here is an overview of the Base Case, Optimistic Scenario and Pessimistic Scenario for 2025 to 2030:

NIO Stock Price Prediction 2025

Base Case: In 2025, if China’s EV market keeps growing, NIO’s sales could rise steadily. If NIO stays focused on quality and building its brand, its stock might be around $25-30 per share by the end of 2025, which could be 50-70% more than now.

Optimistic: If NIO grabs more market share, gets more money for research, and gets lucky with tech breakthroughs or policy changes, its stock could go even higher, maybe $35-40 per share by the end of 2025.

Pessimistic: Economic issues, supply chain problems, or tough competition might slow NIO down. In this case, the stock might move around and end up between $15-20 per share by the end of 2025.

NIO Stock Price Prediction 2026

Base Case: If the market keeps growing and NIO follows its plans, its stock could go up to $35-40 per share by the end of 2026, which could be 70-100% more than now.

Optimistic: With new models, more global markets, and good partnerships, NIO’s stock might climb even higher, maybe $45-50 per share by the end of 2026.

Pessimistic: If unexpected problems like recalls or bad media coverage happen, the stock might drop to $25-30 per share by the end of 2026.

NIO Stock Price Prediction 2027

Base Case: By 2027, NIO making more profit is expected as it grows. If the market keeps growing, the stock could be $45-50 per share by the end of 2027, which could be double what it is now.

Optimistic: Big tech or driving breakthroughs, or NIO becoming a big player globally, could make the stock go way up, maybe $60-70 per share by the end of 2027.

Pessimistic: If China’s EV market slows down or NIO can’t keep up with new tech, the stock might stay the same or fall below $35 per share by the end of 2027.

NIO Stock Price Prediction 2028

Base Case: In 2028, if NIO stays strong in the Chinese EV market and expands internationally, its stock could be around $52-58 per share.

Optimistic: If NIO makes big strides in self-driving tech or gets key partnerships, the stock might surge to $65-75 per share.

Pessimistic: If the economy slows or regulations cause issues, the stock could be around $40-45 per share.

NIO Stock Price Prediction 2029

Base Case: If NIO keeps growing and plans work out, the stock might hit $63-69 per share by 2029.

Optimistic: Profitability, new models, and global expansion could push the stock to $80-90 per share.

Pessimistic: If the EV market saturates or NIO faces problems, the stock might drop to $50-55 per share.

NIO Stock Price Prediction 2030

Base Case: By 2030, if NIO does well and the EV market grows, the stock could be $86-92 per share.

Optimistic: Breakthroughs like better batteries could make the stock soar to $110-130 per share.

Pessimistic: If the EV market faces issues or NIO struggles with tech changes, the stock might fall below $70 per share by 2030.

NIO Stock Price Prediction 2025, 2026, 2027, 2030: Risks and Uncertainties

While our predictions suggest a bright future for NIO, the road to success isn’t without its challenges. Let’s look at some potential problems that could affect NIO stock price prediction 2025, 2030:

Competition: Many companies, like BYD and Li Auto in China, and even international giants like Tesla, are competing with NIO. If NIO makes mistakes or its competitors do something better, it might lose customers and struggle to grow.

Economic Issues: If the global economy slows down, especially in China, people might spend less money. This could mean fewer people buying electric cars, hurting NIO’s sales and profits.

Tech Changes: The electric car industry is always changing with new tech. If NIO doesn’t keep up, especially with things like better batteries or self-driving tech, its stock price could drop.

Supply Chain Problems: Making electric cars needs a lot of parts from different places. If there are issues, like problems between countries or natural disasters, it might slow down NIO’s car production and make things more expensive.

Rules and Regulations: The rules about electric cars are still changing. If there are unexpected rule changes, subsidies stop, or trade rules shift, it could affect how NIO operates and make it harder for them to make money.

Brand Image: People care a lot about what they hear and see online. If there are problems with NIO cars, like recalls or safety issues, it could make people not trust the brand, and fewer people might want to buy NIO cars.

Doing Plans Right: Even with good ideas, doing them right is important. NIO needs to make lots of cars, set up more places to sell them, and make sure they can fix problems after people buy the cars. If NIO faces issues in doing these things well, it might worry investors.

Money Matters: Even if NIO becomes profitable later, staying stable financially is tough. They need to keep spending money on new things and keep talented people on their team. This might make it hard for NIO to manage its money well in the short term.

Also Read: Tesla Stock Forecast & Price Prediction 2025, 2030

Conclusion

Guessing where a stock, especially in the electric car world, will go is like figuring out a path in unknown waters. Our guess says NIO’s future looks good, with its stock possibly doubling or tripling in the next six years. But the journey won’t be smooth; there will be good and tough times.

For those who are excited about NIO, it seems like a good chance to ride China’s growing electric car market. NIO has a strong brand, cool tech, and big plans. But, for those who are careful, there are risks like tough competition, possible economic problems, and tech issues.

The choice to invest in NIO is yours. Think about how much risk you’re okay with, your money goals, and do some research before you decide. Remember, spreading your investments, doing good research, and being careful with risks are like your safety tools in the uncertain stock market.

Whether you decide to join NIO’s journey or watch from afar, one thing is sure: the next six years will be interesting for NIO and might change the electric car world. So, look ahead, get ready, and enjoy the ride!

Disclaimer: This report is just to give you info and not financial advice. Talk to a money expert before you make any investment choices.

Also Read: Best Robotics Stocks to Buy Now in 2024

FAQs

What’s the highest NIO stock price ever?

NIO’s highest stock price was $66.99 per share on February 10, 2021.

What’s the lowest NIO stock price ever?

NIO’s lowest stock price was $1.12 per share on March 16, 2020.

What’s the guess for NIO stock price prediction 2025?

Our guess is NIO stock might be between $25 and $30 per share by the end of 2025, which could be 50-70% more than now.

What’s the guess for NIO stock price prediction 2030?

Our long-term guess is NIO stock might be between $86 and $92 per share by the end of 2030, which could be four times more than now.

What problems can happen if I invest in NIO?

Investing in NIO has risks like tough competition, economic problems, tech changes, supply chain issues, and rules changing. These things could affect NIO’s business and its stock price.

Is it a good idea to invest in NIO?

Deciding to invest in NIO depends on you. Think about how much risk you’re okay with, your money goals, and do some research before deciding. Talk to a money expert before making any choices.

Resources

Here are some resources you can utilize to delve deeper into your research on NIO and the electric vehicle market: