By 2040 Adobe Stock (ADBE) can reach $4291 or more, Here’s Why!

Want to know about Adobe’s future on the market? You’re not alone. This blog post deeply goes into the Adobe stock price prediction, peering into the years ahead to reveal where the company might go. We’ll explore forecasts, and prediction for 2025, 2030, and even 2040. Are you ready to know about the Adobe’s future? Let’s begin!

Adobe Stock Price Prediction 2025, 2030, 2040 (with table and graph)

Let’s see the Adobe stock future of several years including 2025, 2030, 2040 in a table format. Here is a table that showes all the years:

| Year | Low Prediction (USD) | Base Prediction (USD) | High Prediction (USD) |

|---|---|---|---|

| 2025 | 748 | 796 | 828 |

| 2026 | 860 | 906 | 952 |

| 2027 | 977 | 1036 | 1095 |

| 2028 | 1103 | 1190 | 1277 |

| 2029 | 1239 | 1344 | 1449 |

| 2030 | 1384 | 1498 | 1612 |

| 2035 | 2127 | 2434 | 2741 |

| 2040 | 3205 | 3748 | 4291 |

Created by Author (Vinay Kumar Singh)

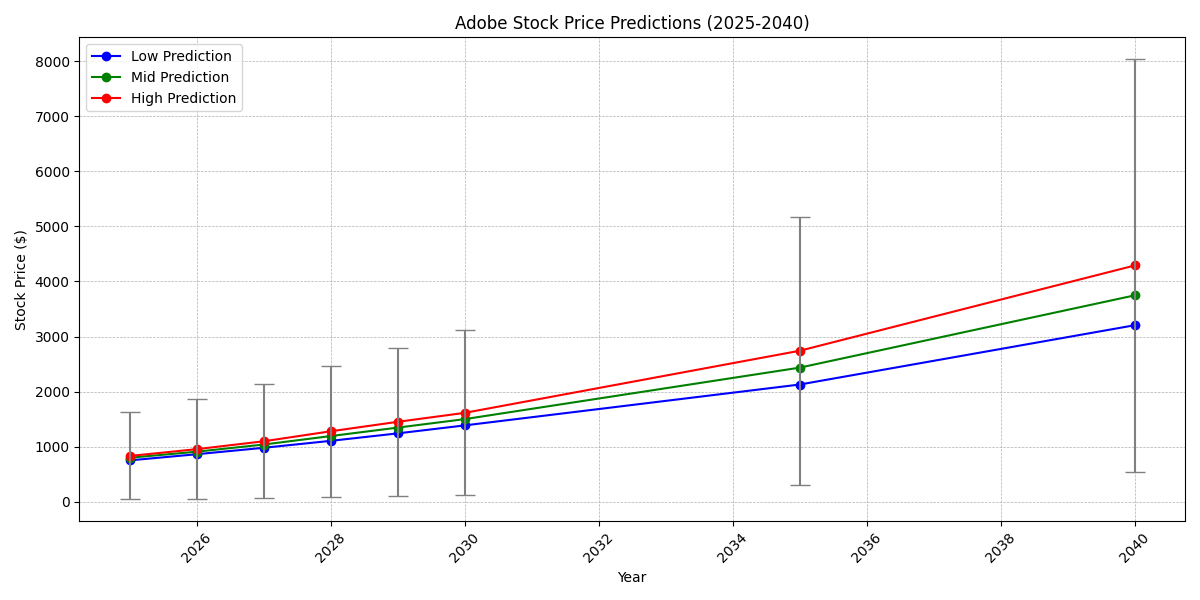

Here a visual graph of the above table represents the several years of Adobe stock price predictions:

Created by Author (Vinay Kumar Singh)

Adobe Stock Price Prediction 2025

Analysts predicts Adobe stock price prediction to reach $796 in 2025, with a expected range between $748 to $828. This prediction is maded by key factors like continued growth in their subscription model, spreading into new markets, etc.

Adobe Stock Price Prediction 2030

Adobe stock price prediction of 2030 is predicted to reach $1,498 with a range of $1,384 to $1,612. This leading growth is based on expected advancements in digital media and marketing, alongside the company’s running focus on cloud-based solutions and Ai.

Adobe Stock Price Prediction 2040

Fast-forward to 2040, the predictions become more uncertain due to the longer timeframe. Anyways, the Adobe stock price prediction in 2040 is almost $3,748, with a potential range of $3,205 to $4,291. This important increase represents that Adobe will continue to adapt and innovate in the evolving new technological landscapes.

Adobe | A Company Overview and Historical Performance

Adobe Inc., was founded in December 1982 by John Warnock and Charles Geschke, Adobe Inc. has formed into a software empire, promoting people and organizations internationally with creative tools and digital media solutions. Here’s a glance into their journey and performance:

Company Overview:

- Industry: Software & Services

- Headquarters: San Jose, California, USA

- Employees: Over 29,000 globally

- Products: Creative Cloud (Photoshop, Illustrator, Premiere Pro, etc.), Acrobat, Document Cloud, Experience Cloud, and more.

- Market Capitalization: Approximately $270 billion (as of February 11, 2024)

Historical Performance

Revenue:

- 1999: $1 billion

- 2012: $4 billion

- 2022: $17.61 billion (fiscal year ended December 2, 2022)

Stock Price:

- Initial Public Offering (1986): $0.17 (split-adjusted)

- February 10, 2024: $391.49 (closing price)

Key Milestones:

- 1985: Release of PostScript, a game-changing page description language.

- 1989: Launch of Photoshop, a revolutionary change in digital image editing.

- 1993: Introduction of Acrobat, the leading PDF software.

- 2013: Launch of Creative Cloud, a subscription-based model for their flagship products.

- 2021: Opening of Marketo, skyrocket their marketing cloud offerings.

Strengths:

- Strong brand recognition and market leadership in creative software.

- Recurring revenue model by subscription services.

- Frequently innovating and expanding into new industry like marketing and experience cloud.

- Strong financial performance with repeated revenue and earnings growth.

Challenges:

- Competition from other software companies and open-source alternatives.

- Emerging technological landscape and the need for continuous adaptation.

- Potential legal and regulatory issues related to data privacy and intellectual property.

However, Adobe’s historical performance has been impressive, showing consistent growth and market leadership. With their focus on innovation, cloud-based solutions, and dynamic offerings, they are well-positioned for continued success in the future. They face competitive and technological challenges that need ongoing adaptation and strategic investments.

Also Read: NVDA stock price prediction 2025 – 2030 | Nvidia Corp

Also Read: Airbnb stock price prediction 2025, 2026, 2027, 2028, 2030

Also Read: Amazon Stock Price Prediction: 2025, 2026, 2027, 2028, 2030

Conclusion

Predicting the future accurately is not guaranteed, and while the provided forecasts offer possible scenarios for Adobe’s stock price, unseen scenarios can shift the landscape. This is why conducting your own research, understanding the market, and considering your personal investment goals are important before making any decisions.

By analyzing past performance, current trends, and expert predictions, we gain valuable insights in Adobe’s potential future. Their strong brand recognition, subscription model, and focus on innovation suggest positive probability, but competition and industry shifts remains ever-present challenges.

Also Read: NEE Stock Price Forecast 2025 – 2030 | Nextera Energy Stock

Also Read: NIO Stock Price Prediction 2025, 2026, 2027, 2030

Also Read: Tesla Stock Forecast & Price Prediction 2025, 2030

FAQ: Frequently Asked Questions

What are the main factors that can influence the Adobe’s stock price?

There are bunch of factors can change Adobe’s stock price, like:

- Company performance: Revenue increase, profitability, market share, and new product releases.

- Industry trends: Growth in creative fields, digital media adoption, and competition from other software companies.

- Economic Health: Interest rates, inflation, and overall economic condition.

- Technological Innovation: New technologies like AI and the metaverse could create new opportunities or challenges.

- Regulatory Scenario: Data privacy regulations and intellectual property laws could impact Adobe’s business model.

Is Adobe a good long-term investment to look for?

It rely on your personal investment goals and risk capacity. While past performance recommend potential for bright future, there are many risks involved in any investment. Always do research and think about your financial situation before making any decisions.

How can I stay informed about Adobe’s stock performance?

Stay updated by following financial news, reading analyst reports, and checking Adobe’s investor relations website. Consider setting up price alerts and news notifications to stay informed about any significant developments.

Resources

- Adobe Investor Relations: https://www.adobe.com/investor-relations.html

- Yahoo Finance (Adobe Stock): https://finance.yahoo.com/quote/ADBE/

- Google Finance (Adobe Stock): https://www.google.com/finance/quote/ADBE:NASDAQ?hl=en

- The Motley Fool (Adobe Analysis): https://www.fool.com/quote/nasdaq/adbe/

- MarketWatch (Adobe News): https://www.marketwatch.com/investing/stock/adbe