Coca-Cola has been synonymous with refreshment and brand recognition in every household. Naturally, investors are curious about the future of this iconic brand and its stock value. This article Coca-cola stock price prediction 2025 – 2040, highlights possible scenarios for Coca-Cola’s stock price over the next two decades.

Coca-Cola stock price prediction 2025 – 2040

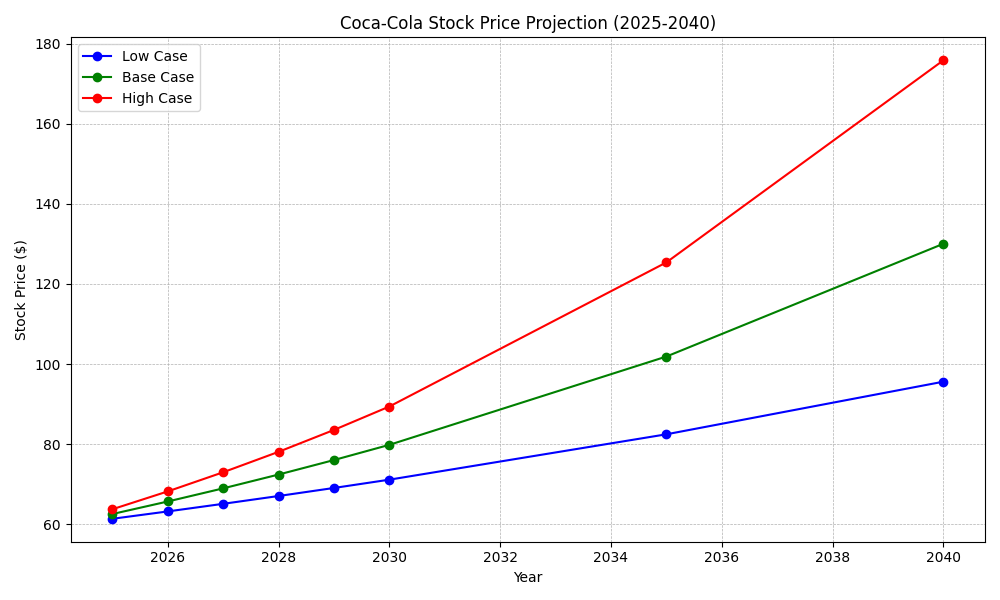

| Year | Low Case (USD) | Base Case (USD) | High Case (USD) |

|---|---|---|---|

| 2025 | 61.36 | 62.55 | 63.74 |

| 2026 | 63.20 | 65.68 | 68.20 |

| 2027 | 65.10 | 68.96 | 72.98 |

| 2028 | 67.05 | 72.41 | 78.08 |

| 2029 | 69.06 | 76.03 | 83.55 |

| 2030 | 71.13 | 79.83 | 89.40 |

| 2035 | 82.46 | 101.88 | 125.39 |

| 2040 | 95.60 | 130.04 | 175.86 |

Created by Author (Vinay Kumar Singh)

Coca-Cola stock price prediction 2025

My own estimate is that Coca-Cola’s share price in 2025 will likely range from $61.36 to $63.74. This suggests that the stock could experience moderate upside from its (current price of $59.57 by February 13, 2024). At this level, there is cautious optimism, meaning people are optimistic but also cautious because the stock may move slightly up or down. On different terms.

Coca-Cola stock price prediction 2030

Coca-Cola’s share price in 2030 could range from $71.13 to $89.40. This wide range reflects increased uncertainty when making forecasts for longer time frames. However, even the lowest forecasts indicate that the stock is likely to rise more than its current value, suggesting that Coca-Cola has the potential for continued growth over the next decade.

Coca-Cola stock price prediction 2040

Coca-Cola NYSE – KO stock price ranges from an estimated high of $95.60 to $175.86 in 2040. Although the upper part of this range may seem ambitious, it underlines the idea that Coca-Cola can experience significant long-term growth under favorable market conditions.

About Coca-Cola

Globally recognized Coca-Cola was founded in 1886 by John S. Pemberton did it. Its original formula included coca leaf extract and kola nut. That is why it was given this name. Coca-Cola has become one of the most iconic and preferred soft drink brands across the globe offering a variety of flavors and packaging options to cater to different consumer preferences. It is known to be a favorite drink in more than 200 countries.

Its success is attributed to sustained marketing efforts, strategic partnerships and commitment to innovation.Constantly adapting to emerging trends and consumer demands, Coca-Cola has maintained its position as a market leader in the beverage industry. And continues to provide freshness and joy to millions of people around the world.

Historical Performance of Coca-Cola Stock Price

Coca-Cola’s historical performance reflects a story of resilience and adaptability. Since its public listing in 1919, the stock has shown consistent growth despite encountering various challenges along the way. Over the past century, the stock price has risen from its initial offering of $40 to over $59 in 2024, marking a remarkable 147% increase when adjusted for splits and dividends. This steady growth underscores Coca-Cola’s ability to expand its brand presence, diversify its product offerings, and endure economic downturns.

Despite the overall upward trajectory, there have been periods of notable volatility. During the Great Depression, the stock price plummeted by 70%, yet Coca-Cola emerged from the crisis stronger, showcasing its adaptability. Similarly, the company weathered the 2008 financial crisis relatively well, thanks to its diversified portfolio.

Coca-Cola’s track record as a dividend champion is noteworthy, with an impressive 60 consecutive years of dividend increases. This consistency underscores the company’s commitment to generating returns for its shareholders and reflects its financial stability and confidence in future prospects.

In recent years, the stock price has shown moderate growth, fluctuating between the $50 and $65 range. While it hasn’t experienced explosive gains, this stability offers reassurance to investors seeking a dependable long-term investment in Coca-Cola.

Also Read: Adobe Stock Price Prediction 2025, 2030, 2040 | Adobe Inc.

Also Read: NVDA stock price prediction 2025 – 2030 | Nvidia Corp

Also Read: Airbnb stock price prediction 2025, 2026, 2027, 2028, 2030

Conclusion

The stock price is projected based on Coca-Cola’s future trends, including both veteran leaders and scientific viewpoints. While the studies left with moderate growth for 2025 indicate optimism, the broader model for 2030 reflects the deep uncertainty associated with pilgrimages. However, even conservative projections suggest continued growth above expected stagnation, indicating Coca-Cola’s ability to continue to adapt and grow. Looking to 2040, a diverse range of predictions highlight the organic nature of the market and significant growth potential. While near-term studies suggest moderate growth, the range of Australian architecture has again been achieved, emphasizing the ongoing development of Coca-Cola’s market performance.

Also Read: NIO Stock Price Prediction 2025, 2026, 2027, 2030

Also Read: NEE Stock Price Forecast 2025 – 2030 | Nextera Energy Stock

Also Read: Tesla Stock Forecast & Price Prediction 2025, 2030

FAQ (Coca-Cola stock price forecast 2025, 2030, 2040)

What factors influence Coca-Cola’s stock price predictions?

Several factors can influence Coca-Cola’s stock price predictions, including its financial performance, market trends, consumer behavior, economic conditions, and competitive landscape. Changes in these factors can affect investor sentiment and influence the stock’s valuation.

How accurate are these(Coca-Cola) stock price predictions?

Stock price predictions are based on various analytical models, market research, and expert opinions. While they provide valuable insights, it’s important to remember that they are not guarantees of future performance. Actual stock prices may vary due to unforeseen events and changes in market dynamics.

Are there any risks associated with investing in Coca-Cola stock?

Like any investment, investing in Coca-Cola stock carries inherent risks. These may include market volatility, changes in consumer preferences, regulatory developments, competition and company-specific factors. Investors should consider these risks carefully before investing and diversify their portfolios to minimize potential losses.

Where can I find more information about Coca-Cola and its stock price?

Several resources can provide further insights:

• Coca-Cola’s investor relations website.

• Financial news websites and reports.

• Investment research firms and analysts.

• Industry publications and reports.

Resources: (Coca-Cola stock price prediction)

• Bloomberg: https://www.bloomberg.com/quote/KO:US

• Reuters: https://www.reuters.com/companies/KO.N

• MarketWatch: https://www.marketwatch.com/investing/stock/ko

• Seeking Alpha: https://seekingalpha.com/symbol/KO