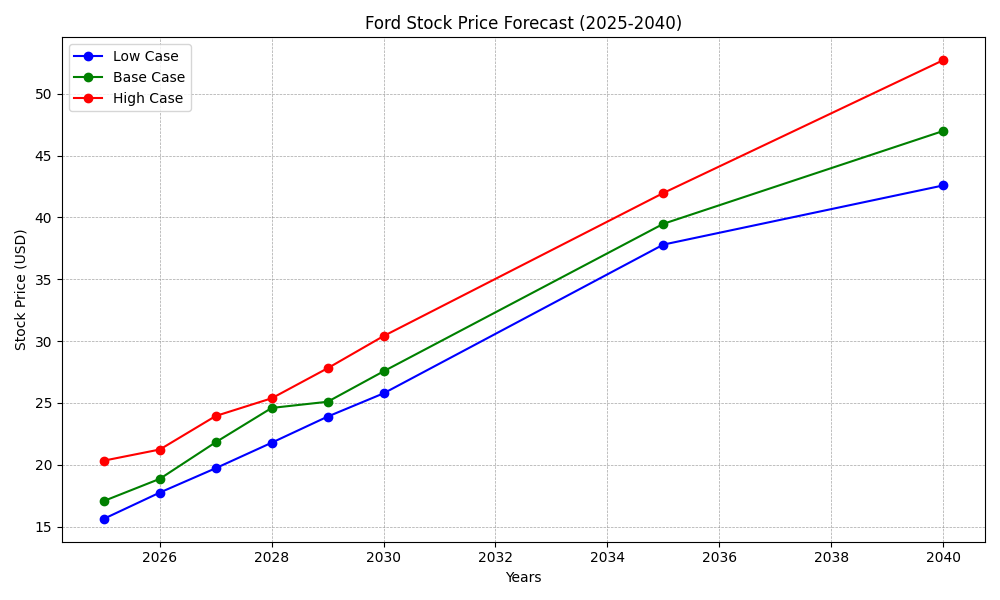

According to Ford stock forecast, Ford’s price will reach $20.34 by the end of 2025, then reach $30.41 by the end of 2030. After that, it is expected to go up to $52.70 in 2040.

Ford Stock Forecast & Price Prediction 2025, 2030, 2040

Here is a table showing the ford’s stock forecast and predictions:

| Year | Low Case | Base Case | High Case |

|---|---|---|---|

| 2025 | $15.64 | $17.08 | $20.34 |

| 2026 | $17.76 | $18.87 | $21.24 |

| 2027 | $19.73 | $21.83 | $23.95 |

| 2028 | $22.79 | $24.60 | $25.38 |

| 2029 | $23.90 | $25.10 | $27.81 |

| 2030 | $25.78 | $27.56 | $30.41 |

| 2035 | $37.80 | $39.48 | $41.97 |

| 2040 | $42.58 | $46.98 | $52.70 |

Created by Author (Vinay Kumar Singh)

Ford stock forecast & price prediction 2025

In 2025, Ford stock forecast price is projected to be $17.08 and in between $15.64 and $20.34 per share. The range reflects uncertainties surrounding the company’s near-term prospects, including the success of its ongoing electric vehicle (EV) rollout and macroeconomic conditions.

Ford stock forecast & price prediction 2030

By 2030, Ford stock forecast price is expected to rise to $27.56 and in the range of $25.78 and $30.41 per share. This wide range points to the growing influence of factors such as Ford’s long-term EV strategy and the overall performance of the automotive industry in the coming years.

Ford stock forecast & price prediction 2040

Looking to 2040, the Ford stock forecast price increases further to $46.98 and in $42.58 to $52.70 per share. This significant spread underlines the challenges of predicting the distant future. Factors such as widespread adoption of autonomous vehicles and changing transportation trends could significantly impact Ford’s stock price by 2040.

Overview of Ford

Ford, which has become synonymous with automobiles in every household, boasts of a rich history dating back to 1903. Founded by Henry Ford, the company revolutionized the industry with the introduction of the iconic Model T, making cars affordable to the masses. Over the years, Ford has established itself as a major player in the global automotive market. Which offers a diverse range of vehicles ranging from iconic trucks like the F-Series to popular sedans like the Mustang.

Today, Ford finds itself at a turning point. The automotive industry is undergoing a significant transformation, driven by the rapid development and adoption of electric vehicles (EVs). As traditional car giants grapple with this transition, Ford is actively investing in EV technology and innovation. The aim of which is to achieve a strong position in the future of transportation.

Ford’s current financial performance

Ford has had a mix of good and not-so-good financial results lately. Their regular car and truck business is doing well and making a lot of money, but their electric car business, called Ford Model e, is not profitable yet. Even though they sold more electric cars in 2023, they still lost money overall. This shows that while Ford is trying to move towards electric cars, it’s costing them money right now.

Ford’s Industry Position

Ford is still a big player in the car industry and was the second-largest seller of electric cars in the United States in 2022. But, the competition is getting tougher with other big car companies like General Motors and Toyota, as well as new companies like Tesla, all trying to sell electric cars too. With more electric cars being made, Ford has to work harder to stay competitive.

Ford’s transition to electric cars

Ford knows that electric cars are important for the future, so they’re spending a lot of money to make more of them. They’ve promised to invest over $50 billion in electric cars by 2026 and want to sell a lot more electric cars every year. Some of their electric cars, like the Mustang Mach-E and F-150 Lightning, have been popular. But, Ford still has to figure out how to make more electric cars and keep the costs down. Plus, they have to catch up with other companies who’ve been selling electric cars for longer.

Also Read: Tesla Stock Forecast & Price Prediction 2025, 2030

Also Read: NIO Stock Price Prediction 2025, 2026, 2027, 2030

Also Read: Lucid Stock Price Prediction 2025, 2030, 2040

Conclusion

Ford’s stock price forecast offers different possibilities for investors to think about. The near-term outlook for 2025 depends on things like Ford’s electric car plans and how the economy is doing. But the longer-term predictions for 2030 and 2040 are based on bigger trends in the car industry and how transportation is changing.

Just like any guess about the future, these predictions have some uncertainty and things that can change. Stuff like new technology, how other car companies are doing, government rules, and what people want to buy can all affect how Ford’s stock does.

So, investors should do their homework, think about different possibilities, and keep an eye on what’s happening with Ford and the car industry. This way, they can make smart choices that fit with what they want and how much risk they’re comfortable with.

Also Read: Apple stock price prediction 2025, 2030, 2040

Also Read: Microsoft Stock Price Prediction 2025, 2030, 2040

Also Read: Meta stock price prediction 2025, 2030, 2040

Frequently Asked Questions (FAQ): Ford Stock Forecast

What is Ford Motors?

Ford Motors, commonly known as Ford, is an American multinational automobile manufacturer founded by Henry Ford in 1903. It is one of the largest and oldest automobile manufacturers globally, producing a wide range of vehicles including cars, trucks, SUVs and electric vehicles. EVS).

Why is Ford important in the car industry?

Ford is important because it has a long history of making cars, introducing new ideas, and selling cars all over the world. They made cars cheaper for regular people with the Model T and have popular cars like the F-Series trucks and Mustang sports car.

How is Ford dealing with electric cars?

Ford knows that electric cars are becoming more important, so they’re spending a lot of money on electric car technology. They’ve made electric versions of some of their popular cars like the Mustang Mach-E SUV and F-150 Lightning truck to meet the growing demand for eco-friendly cars.

What factors influence Ford’s stock price forecast?

Ford’s stock price forecast is influenced by various factors, including its electric vehicle (EV) rollout, economic conditions, technological advancements, market competition, regulatory changes, and consumer preferences. Short-term outlooks for 2025 are impacted by Ford’s EV plans and economic trends, while long-term projections for 2030 and 2040 consider broader industry trends and transportation changes.

How accurate are stock price forecasts for Ford?

Stock price forecasts, including those for Ford, come with uncertainties and variability. While they provide insights into potential future trends, unforeseen events and changes in market conditions can affect actual stock performance. Investors should use forecasts as a tool for informed decision-making rather than as guarantees of future outcomes.

What should investors consider when evaluating Ford’s stock price forecast?

Investors should conduct thorough research, consider different scenarios, and stay informed about Ford’s developments and industry trends. Factors to consider include Ford’s EV strategy, competition in the automotive market, regulatory landscape, technological advancements, and consumer preferences. By staying informed and evaluating various factors, investors can make informed investment decisions aligned with their goals and risk tolerance.

Resources

- Ford Motor Company Investor Relations: https://shareholder.ford.com/Investors/Home/default.aspx

- TipRanks – Ford Motor Company (F): https://www.tipranks.com/stocks/f/forecast

- StockAnalysis.com – Ford Motor Company (F): https://www.tipranks.com/stocks/f/forecast

- U.S. Energy Information Administration – Electric Vehicles: https://www.eia.gov/todayinenergy/index.php?tg=%20vehicles

- International Energy Agency – Global EV Outlook 2023: https://www.iea.org/reports/global-ev-outlook-2023