BlackRock Stock Forecast & Price prediction is estimated to reach $1109 by the end of 2025, then reach $1665 by the end of 2030. After that, it is expected to go up to $3202 in 2040.

BlackRock Stock forecast & price prediction 2025, 2030, 2040

Here is a table showing the price predictions of years:

| Year | Low Case (USD) | Base Case (USD | High Case (USD) |

|---|---|---|---|

| 2025 | 788 | 908 | 1109 |

| 2026 | 823 | 1004 | 1289 |

| 2027 | 865 | 1145 | 1372 |

| 2028 | 932 | 1242 | 1446 |

| 2029 | 978 | 1397 | 1550 |

| 2030 | 1020 | 1479 | 1665 |

| 2035 | 1479 | 1799 | 2198 |

| 2040 | 2244 | 2606 | 3202 |

Created by Author (Vinay Kumar Singh)

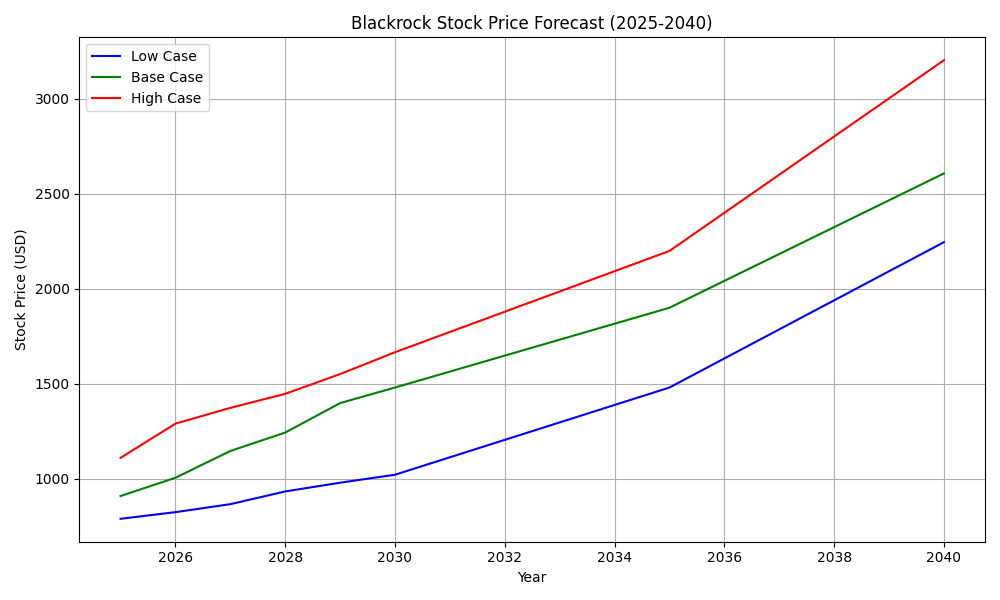

Here is graph showing the above table data:

BlackRock stock forecast & price prediction 2025

In 2025, BlackRock stock price could be $908 between $788 and $1109. This depends on how well the economy is going and what’s happening in the industry. If things go really well, the stock price could be closer to $1150, but if there are problems, it could be closer to $780.

BlackRock stock forecast & price prediction 2030

By 2030, BlackRock stock price could be $1479 between $1020 and $1665. This wide range considers how much the industry is growing and whether BlackRock is doing well BlackRock at taking advantage of that growth. If the global economy is strong and BlackRock’s plans work out, the stock price could be closer to $1650. But if there are economic troubles or unforeseen problems in the industry, it could be closer to $1020.

BlackRock stock forecast & price prediction 2040

In 2040, BlackRock stock price could be $2606 between $2244 and $3202. This huge growth potential depends on how well BlackRock is able to adapt to changes in the investing world and whether it maintains its success. If the global economy continues to grow and BlackRock stays ahead of the game, the share price could be close to $3200 by 2040.

BlackRock Overview

BlackRock, Inc. is an investment management giant that holds the title of the world’s largest asset manager with over $10 trillion under management (as of December 31, 2023). Headquartered in New York City, BlackRock’s reach extends far and wide, with offices in 38 countries and clients in over 100 countries.

They offer a diverse range of investment solutions for both individuals and institutions. BlackRock is perhaps most recognized for its iShares exchange-traded funds (ETFs), a popular investment vehicle for those investing in various market segments. Beyond ETFs, BlackRock offers mutual funds, closed-end funds, and a variety of asset classes, including stocks, bonds, commodities, and real estate.

Financial Performance

BlackRock’s status as the world’s largest asset manager is mirrored by its impressive financial performance. To gain insight into its future prospects, it’s essential to delve into its past financial stability. Examining key metrics such as revenue, earnings per share (EPS), and assets under management (AUM) growth provides valuable insights.

Historically, BlackRock has demonstrated consistent revenue growth, indicating an uptick in client assets and the associated fees earned from managing those assets. This steady revenue trajectory underscores the company’s ability to attract and retain clients while effectively monetizing its services.

Moreover, BlackRock’s healthy and ascending EPS reflects its adeptness at converting revenue into shareholder profit. A rising EPS trend signifies efficient resource management and value creation for investors, highlighting BlackRock’s strong financial footing.

Assets under management (AUM) serve as a pivotal metric for investment management firms like BlackRock. A continuous increase in AUM signals investor trust in BlackRock’s investment strategies and its capacity to generate favorable returns. This growing confidence further solidifies BlackRock’s position as a leading player in the investment management industry.

Also Read: Tesla Stock Forecast & Price Prediction 2025, 2030

Also Read: Apple stock price prediction 2025, 2030, 2040

Also Read: Coca-Cola Stock price prediction 2025, 2030, 2040

Conclusion

BlackRock is the biggest asset manager globally because it’s really good with money. It keeps making more money over time, its profits are healthy, and it’s managing more and more money from clients. This shows that BlackRock knows how to handle people’s money well and make profits for its investors. In the future, BlackRock’s strong financial base and dedication to serving clients and making smart investments mean it’s likely to keep growing and doing well in the changing financial world.

Also Read: NVDA stock price prediction 2025 – 2030 | Nvidia Corp

Also Read: Amazon Stock Price Prediction: 2025, 2026, 2027, 2028, 2030

Also Read: Ford stock forecast & price prediction 2025, 2030, 2040

Frequently Asked Questions (FAQ)

What is BlackRock?

BlackRock, Inc. is a leading global investment management corporation headquartered in New York City. It’s renowned as the world’s largest asset manager, overseeing trillions of dollars in assets for clients worldwide.

What services does BlackRock offer?

BlackRock offers a diverse range of investment solutions for both individuals and institutions. These include exchange-traded funds (ETFs), mutual funds, closed-end funds, and various asset classes such as stocks, bonds, commodities, and real estate.

Is investing in BlackRock Stock a good idea?

Investing in BlackRock can be appealing for investors seeking exposure to the financial services sector and the broader investment management industry. However, like any investment, it’s essential to conduct thorough research, consider your financial goals and risk tolerance, and consult with a financial advisor before making any investment decisions.

What might Blackrock stock price be in 2025?

The forecast suggests it could be between $780 and $1150 in 2025. This range depends on how the economy is doing and what’s happening in the market.

Will Blackrock stock be worth $2000 by 2030?

In 2030, it could be between $1020 and $1650. Reaching $2000 depends on a strong economy and Blackrock’s success.

Could Blackrock stock reach $3000 by 2040?

By 2040, it might be between $2200 and $3200. Reaching $3000 needs a thriving economy and Blackrock’s growth, but unexpected events could change this.

Resources

Blackrock Investor Relations – https://ir.blackrock.com/home/default.aspx

MarketWatch – https://www.marketwatch.com/investing/stock/blk

Reuters – https://www.reuters.com/company/blackrock-inc/

Investopedia – https://www.investopedia.com/terms/a/

The Motley Fool – https://www.fool.com/quote/nyse/blk/