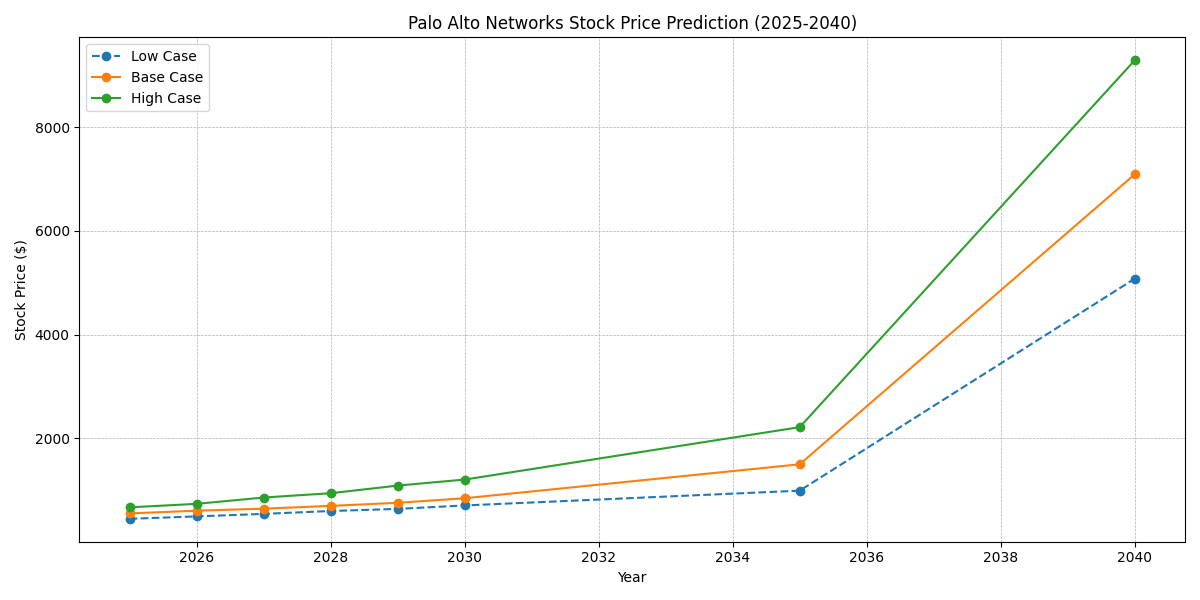

According to the prediction, the Palo Alto stock price will reach $673 by the end of 2025, then $1208 by the end of 2030. After that, it is expected to go up to $9288 in 2040.

Palo Alto Stock Price Prediction 2025, 2030, 2040

Here’s a table showing the Palo Alto’s stock price predictions of several years including 2025, 2030, and 2040:

| Year | Low Case (USD) | Base Case (USD) | High Case (USD) |

|---|---|---|---|

| 2025 | 452 | 556 | 673 |

| 2026 | 498 | 608 | 740 |

| 2027 | 547 | 647 | 862 |

| 2028 | 602 | 701 | 945 |

| 2029 | 643 | 760 | 1092 |

| 2030 | 709 | 848 | 1208 |

| 2035 | 994 | 1502 | 2218 |

| 2040 | 5079 | 7090 | 9288 |

Created by Author (Vinay Kumar Singh)

Here’s a visual graph showing the above table data:

Palo Alto stock price prediction 2025

In 2025, forecasts predict that Palo Alto’s stock price could be between $452 to $673, depending on how much people need cybersecurity, new product releases, and how the overall market is doing.

Palo Alto stock price prediction 2030

In 2030, forecasts predict that Palo Alto’s stock price could be between $709 and $1,208. This forecasting depends largely on predicting how technology, industry, and larger world events will play out in the future.

Palo Alto stock price prediction 2040

In 2040, forecasts predict that Palo Alto’s stock price could range from $5,079 to $9,288. But reaching that price will depend on many factors.

Overview of Palo Alto Networks (PANW)

Palo Alto Networks (PANW) is a leading cybersecurity company based in Santa Clara, California. They were started in 2005 and are known for their fancy next generation firewall (NGFW). These firewalls are smarter than older firewalls because they can detect complex cyber threats even when they are hidden.

In addition to NGFW, PANW also provides other safety materials such as:

- Cloud Security: Protecting cloud content from attacks.

- Endpoint Security: Protecting computers and mobile devices from viruses and hackers.

- Network Security: Offering a lot of security tools for networks and data centers.

- Threat Intelligence: Providing real-time updates on new cyber threats through our Unit 42 research team.

Palo Alto Network (PANW) helps all types of businesses, from small companies to large companies across various industries, stay safe from cyber attacks. They are known for always bringing new ideas to keep pace with the changing world of cyber security. So, they are a company to keep an eye on in the future.

Historical Performance of the Palo Alto Networks (PANW)

As of February 26, 2024, Palo alto stock price (PANW) is $299.41 per share, which is a big increase from its initial price of $38 per share when it first became available to buy in 2012.

Looking closer, PANW has been growing a lot over the past five years, with its value increasing by around 35% every year. This growth happened because more people need cybersecurity solutions, and PANW expanded its products and bought other companies.

But it wasn’t always smooth sailing. In 2022, when the overall stock market dropped, PANW’s share price also fell below $200 briefly. However, the company recovered, showing it can handle tough times.

In the past year, PANW’s returns were about 20%, showing it can still do well even when the market is tough.

Over the last five years, Palo alto stock price has almost quadrupled, meaning it’s gone up by almost four times, which shows that people believe in PANW’s potential and trust it as an investment.

Key Considerations for PANW Investors

Investors should keep an eye on palo alto stock price predictions as they can offer a glimpse of the possible future, but they should not be used as the sole basis for investment decisions. Astute investors consider a variety of additional factors before committing their capital:

1. Company Fundamentals:

- Financial health: Analyze PANW’s financial statements to assess its revenue growth, profitability, debt levels, and cash flow. A strong financial foundation suggests a company’s sustainability and potential for future growth.

- Competitive landscape: Evaluate the competitive environment and PANW’s ability to maintain its market share against established players and emerging startups.

- Management team: Research the competence and experience of PANW’s leadership team, as their decisions significantly impact the company’s direction and success.

2. Market Conditions:

- Overall market trends: Consider the broader economic climate and its potential impact on the technology sector and cybersecurity industry in particular.

- Interest rates: Rising interest rates can make stocks less attractive compared to other investments, influencing the price of PANW shares.

- Investor sentiment: Gauge the overall sentiment towards PANW and the cybersecurity industry, as investor confidence can significantly influence stock prices.

3. Investment Horizon:

- Short-term vs. long-term goals: Determine your investment horizon. If you have a short-term goal, focusing on the near-term price predictions might be relevant. However, for long-term investors, focusing on the company’s fundamentals and future potential holds greater importance.

4. Risk Management:

- Diversification: Don’t put all your eggs in one basket. Diversify your portfolio across different asset classes and industries to mitigate risk.

- Risk tolerance: Be honest about your risk tolerance and choose investments that align with your comfort level.

- Stop-loss orders: Consider setting stop-loss orders to limit potential losses if the stock price falls below a certain level.

5. Continuous Research:

- Stay informed: The technology and cybersecurity landscape is constantly evolving. Keep yourself updated on industry trends, PANW’s performance, and any relevant news that could impact its future.

By considering these factors in conjunction with price predictions, investors can make informed and well-rounded decisions when considering investing in Palo Alto Networks.

Also Read: Adobe Stock Price Prediction 2025, 2030, 2040 | Adobe Inc.

Also Read: Coca-Cola Stock price prediction 2025, 2030, 2040

Also Read: Microsoft Stock Price Prediction 2025, 2030, 2040

Conclusion

The future of Palo alto stock price (PANW) depends on a few important things. How well they keep coming up with new ideas, deal with competition. PANW has done well before, has good products, and focuses on making security better. That makes it a company to watch in the fast-changing world of tech and cybersecurity.

But remember, these guesses are just guesses – they’re not certain. Smart investors look at more than just what might happen to the price. They check out how the company is doing, what’s going on in the market, how long they want to invest for, and how they plan to manage risks. By doing their homework, spreading their investments, and staying up-to-date, investors can feel hopeful but careful about PANW’s future and make smart choices.

Also Read: Meta stock price prediction 2025, 2030, 2040

Also Read: Apple stock price prediction 2025, 2030, 2040

Also Read: Datadog stock price prediction 2025, 2030, 2040 Why datadog is a opportunity?

Frequently Asked Questions (FAQ)

What factors influence the prediction of Palo alto stock price?

Several factors can influence Palo alto stock price prediction, including the demand for cybersecurity solutions, the company’s financial performance, market conditions, and broader economic trends.

What does Palo Alto Networks do?

Palo Alto Networks is a leading cybersecurity company that provides advanced security solutions to protect organizations from cyber threats. They offer a range of products and services, including next-generation firewalls, cloud security, endpoint protection, and threat intelligence.

How long has Palo Alto Networks been in business?

Palo Alto Networks was founded in 2005 and has since become a prominent player in the cybersecurity industry. With over 15 years of experience, they have established themselves as a trusted provider of cybersecurity solutions worldwide.

What makes Palo Alto Networks different from other cybersecurity companies?

Palo Alto Networks stands out for its innovative approach to cybersecurity, leveraging cutting-edge technology to offer superior protection against evolving threats. Their Next-Generation Security Platform integrates advanced security features, including machine learning and AI-driven analytics, to provide comprehensive security across network, cloud, and endpoint environments.

How often are Palo Alto stock price predictions updated?

Stock price predictions for Palo Alto and other companies are typically updated periodically based on new information, changes in market conditions, and revisions to analysts’ forecasts. Investors should regularly check for updated analyses and forecasts to stay informed.

What are the estimated future 2025 stock price ranges for PANW?

According to forecasts, PANW’s stock price could range from $452 (low case) to $673 (high case) by 2025.

Resources Palo Alto Networks (PANW)

• Palo Alto Networks Investor Relations: https://investors.paloaltonetworks.com/

• Yahoo Finance – PANW: https://finance.yahoo.com/quote/PANW/

• Reuters – PANW: https://www.reuters.com/markets/companies/PANW.OQ/profile/

• Bloomberg – PANW: https://www.bloomberg.com/quote/PANW:US