Tesla stock has been really interesting for more than ten years, going from small to a big leader in electric cars. Now, in the upcoming next six years (2025-2030) in the tesla stock forecast cool things are expected to happen. More people around the world using electric cars, new tech improvements, and other changes could affect how Tesla’s stock does. This report gives a full picture of what might happen to Tesla’s stock price, talking about both positive and not-so-certain possibilities and explaining what could make these things happen.

Methodology of Tesla Stock Forecast

To figure out what might happen to Tesla’s stock in the future, we use a mix of smart analysis and some good guesses. Our main tool is a strong financial model, which looks at how Tesla did before, predicts how they might do in the future, and checks what could change things. We consider how many cars they might make and sell, where their money comes from (like selling energy storage and software), and if they can save money on things.

We also look at what big financial institutions and experts say about how the world’s economy is doing and what might change in the electric car world. This includes things like how much money is being made around the world, interest rates, and what other companies are doing.

We don’t just stick to numbers – we also look at other important stuff. This includes what makes Tesla special compared to other companies, what cool tech things they’re doing, and how people see their brand. We read reports, check out industry news, and keep an eye on the latest tech trends.

Lastly, we know that the future can be a bit unpredictable. So, we don’t just give one answer. We show a range of possibilities for each year, thinking about unexpected events that could happen. This way, investors can see the good and not-so-good things that might come with investing in Tesla.

Putting all these ways of looking at things together helps us make a forecast for Tesla’s stock price. We want to give investors a clear and smart view of what could happen so they can make good decisions based on how much risk they’re okay with and what they want to achieve with their investments.

Economic and Market Outlook

Thinking about what might happen to Tesla’s stock in the next six years means taking a good look at the big picture of money and markets worldwide. While it’s not easy to predict exactly what will happen, having a general understanding is important for figuring out how Tesla might do.

Here’s what it looks like overall: People are generally feeling hopeful about the future of the economy. But, there are some big uncertainties, like issues between countries and the chance of the economy slowing down. The expectation is that the economy will keep growing, but maybe not as fast as right after the pandemic.

One super important thing for Tesla is the rise of electric cars (EVs). More and more people are expected to buy electric cars in the coming years because batteries are getting cheaper, governments are giving incentives, and people care more about the environment. Some experts even think that over half of all cars sold globally could be electric by 2040.

When it comes to cars, Tesla might have more competition. Other big car companies are spending lots of money to make their electric cars and give Tesla a run for its money. Also, there are new companies doing interesting things, which might shake up the car market. This could affect how much of the market Tesla gets and how much money it makes.

Looking beyond just cars, new and cool technologies will also matter for Tesla. Things like self-driving cars, smart computers, and cleaner energy could bring new opportunities. But, there might be rules and regulations that make things tricky for these technologies, and that could be a challenge for Tesla too.

Tesla’s Business Prospects

Now, let’s check out what’s happening inside Tesla. We’ll see how they’re doing, where they might grow, and what problems they could face. This will help us understand how well they might do in the future and how that could affect their stock price.

Big Growth Ahead: Tesla is gearing up for some serious growth. They’re in the middle of a big opportunity with more people wanting electric cars. The plan is to sell a lot more cars, especially in places like China and Asia. But that’s not all – they’re also getting into other things like storing energy, making solar panels, and offering software services. All of this could bring in more money and make Tesla even stronger.

Always doing something new: What sets Tesla apart is how much they love coming up with new things. Tesla boss Elon Musk is busy pushing his limits. They’re not just making better car batteries or cars that can drive themselves; They are also working on futuristic vehicles like Cybertruck and Semi. Due to being ahead in technology, Tesla remains ahead in electric cars.

Going Global: Tesla doesn’t want to stop at just a few places; they want to go everywhere. They’re thinking about building huge factories in new spots like India and Southeast Asia. They’re even looking at making flying taxis. Going global and trying out new things could bring even more growth, but it won’t be easy – there are challenges to figure out.

More Competition: Even though Tesla is ahead right now, other car companies are catching up. Big names like Volkswagen and Ford are getting serious about electric cars. New companies like Rivian and Lucid are also making a name for themselves. With more players in the game, Tesla has to work hard to stay on top.

Possible Problems: Along the way, Tesla might hit some road bumps. Prices for materials might go up, making things more expensive. Sometimes, getting the right parts for the cars might be tricky. Rules and regulations can also change unexpectedly. People are also keeping an eye on Elon Musk – distractions like his Twitter adventures could make investors a bit nervous. How well Tesla handles these challenges will decide if they reach their big goals.

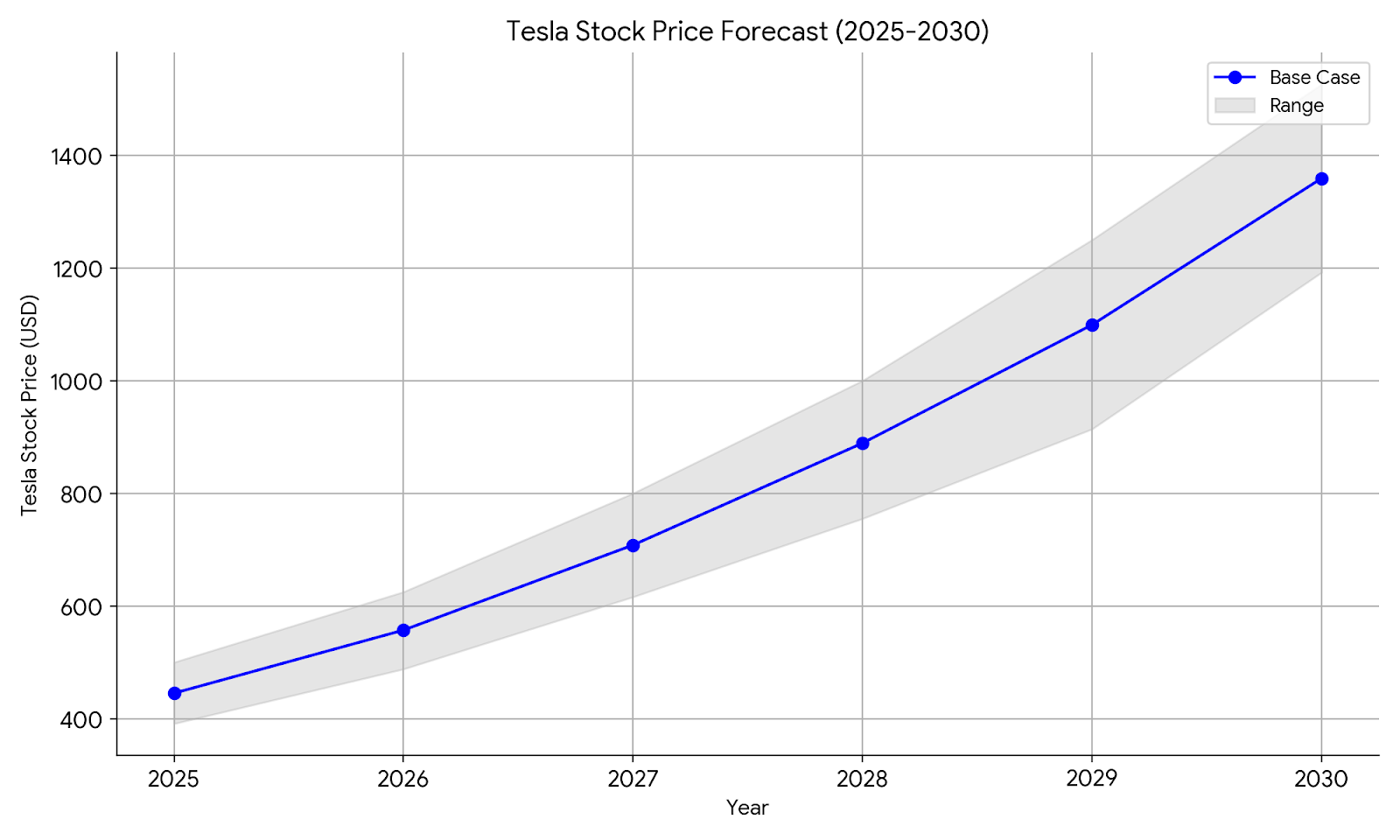

Tesla Stock Price Forecast (2025-2030)

| Year | Base Case | Bullish Case | Bearish Case |

|---|---|---|---|

| 2025 | $445 | $500 | $391 |

| 2026 | $557 | $625 | $488 |

| 2027 | $708 | $800 | $616 |

| 2028 | $889 | $1,000 | $755 |

| 2029 | $1,099 | $1,250 | $914 |

| 2030 | $1,359 | $1,526 | $1,192 |

Notes:

- The base case remains the most likely scenario based on our analysis.

- The bullish case represents highly favorable conditions exceeding the optimistic scenario, such as even faster EV adoption, major market share gains through innovation, and significant technological breakthroughs.

- The bearish case reflects potential challenges exceeding the conservative scenario, including intense competition from established automakers and startups, major economic downturns, and severe supply chain disruptions or regulatory hurdles.

Challenges and Risks in Tesla’s Path

While Tesla’s future holds great promise, it’s essential to remember that every journey has unexpected twists. Moving towards its expected stock price involves recognizing big risks and uncertainties that could disrupt well-thought-out plans.

More Competition: Tesla isn’t the only player in the electric vehicle game. Big car companies like Volkswagen and Toyota are investing heavily in electric vehicles, and newer companies like Rivian and Lucid Motors pose specific challenges. This increased competition may tighten Tesla’s profits and test its ability to stay ahead.

Economic Changes: The world’s economic health can affect any growth plans. Recessions or trade disputes might lower people’s interest in buying cars, affecting Tesla’s production and deliveries. Also, if interest rates go up, it might make investing in growing companies like Tesla less appealing, causing ups and downs in the stock market.

Tech Challenges: Tesla relies a lot on its advanced technology. But unexpected issues with developing batteries, making cars drive autonomously, or problems with software could delay new products and make customers less confident. Rules around these new technologies could also slow down progress and change Tesla’s plans.

Worldwide Politics: Global politics can have a big impact on any long-term plans. Trade problems, conflicts in different parts of the world, and not having enough resources could cause issues with making cars, shipping them, and selling them worldwide. These unpredictable factors make it harder to predict Tesla’s future.

Unexpected Surprises: The world is full of unexpected events, and the tech and car industries are always changing. A new company, a breakthrough in making better batteries, or a major problem with autonomous cars could completely change things for Tesla. Being aware of these possibilities helps investors make smart choices and adjust plans for the future.

Talking about these possible problems isn’t to make things sound bad. It’s about being honest and really understanding the challenges. Knowing about these risks helps people make smart choices and change plans when needed as we move into an uncertain future.

Conclusion

Thinking about what might happen to Tesla’s stock price is like balancing between being really hopeful and being careful. Tesla has a lot of potential because more people want electric cars, and Tesla keeps coming up with new ideas. But, getting to that dream price involves dealing with tough competition, not being sure about the economy, and unexpected problems with technology.

For investors, the trick is to be smart and look ahead. Knowing what might go well and what could be a problem helps you make good choices, based on how much risk you’re okay with. Whether you want to go slow and get small gains, take a bit of risk but keep things balanced, or go all in for big returns, sailing with Tesla needs a clear plan and steady decisions.

It’s not a simple trip where you’re sure to end up in one place. Get used to the ups and downs, change your plan when needed, and keep your eyes on the far-off goal. Doing this turns the sometimes surprising journey with Tesla into an exciting ride, where you might just get some great rewards from being part of the big change to electric cars.

FAQ (Frequently Asked Questions)

Q: Is Tesla’s stock price guaranteed to rise over the next six years?

A: Unfortunately, no forecast can guarantee future performance. While the analysis presented paints a picture of potential growth, unforeseen events or significant challenges could impact Tesla’s trajectory and alter the predicted outcomes. However, the forecast considers multiple scenarios and accounts for potential risks to provide a comprehensive view of the possibilities.

Q: Will Tesla’s stock price definitely be what you predict?

A: No, these are just guesses, not sure things. Even though we’ve thought a lot about them, unexpected stuff or changes in how the market works could really change the real stock price. Just remember, putting money in stocks always comes with not being totally sure.

Q: Is a long-term investment horizon important for Tesla?

A: Yes! The electric car market is still changing, and Tesla’s growth might face some challenges. Holding onto your investment during market ups and downs and thinking about the future for a long time is really important to get the most out of it.

Q: Can we be sure Tesla’s stock price will go up by 2030?

A: Our forecast sees a lot of potential growth, but remember, nothing is guaranteed in the future. Many things, like the economy, competition, and unexpected events, can affect the stock price. So, think of the forecast as a guide.

Q: What are the biggest risks for Tesla’s stock price?

A: Tough competition from other carmakers, economic problems, and unexpected issues with new technology are the biggest risks. Also, problems in different parts of the world and rules that Tesla has to follow can cause disruptions.

Resources

Financial News Websites:

- Bloomberg: https://www.bloomberg.com/

- CNBC: https://www.cnbc.com/

- The Wall Street Journal: https://www.wsj.com/

Tesla Investor Relations Website:

2 thoughts on “Tesla Stock Forecast & Price Prediction 2025, 2030”

I could become a millionaire if I buy 20,000. Worth of Tesla I’m thinking about it!

Thanks for sharing your thoughts! Investing in Tesla could give exciting opportunities, but keep in mind that before making any decisions do your research and consider your investment goals and risk capacity. While Tesla has shown remarkable growth potential, you have to see investing as a marathon not sprint. Good luck in your investment journey!